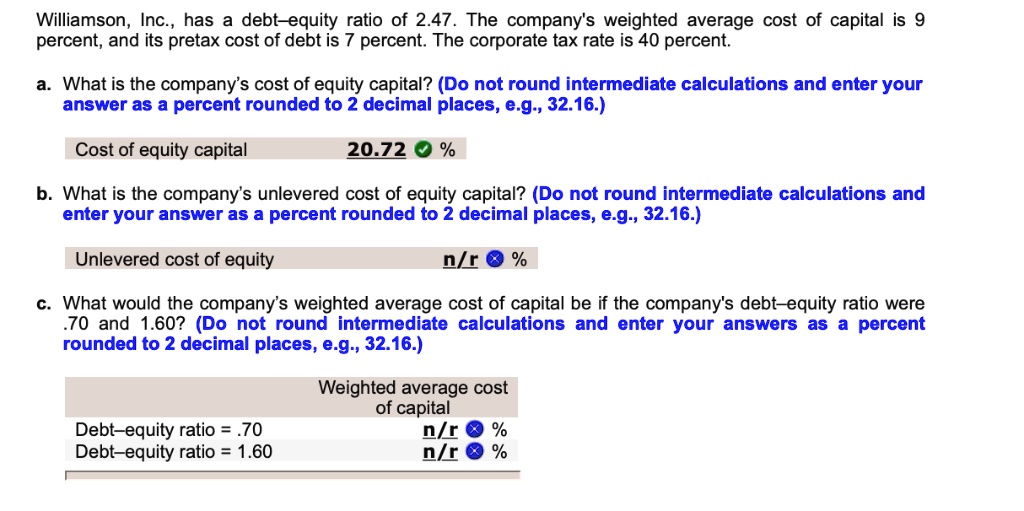

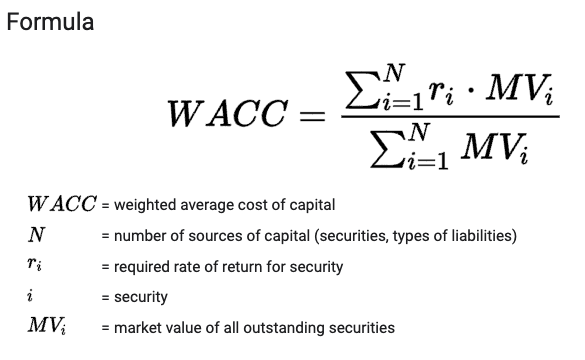

Twice Shy Industries has a debt-equity ratio of 1.5. Its WACC is 7.9 percent, and its cost of debt is 6.8 percent. The corporate tax rate is 35 percent. a. What is

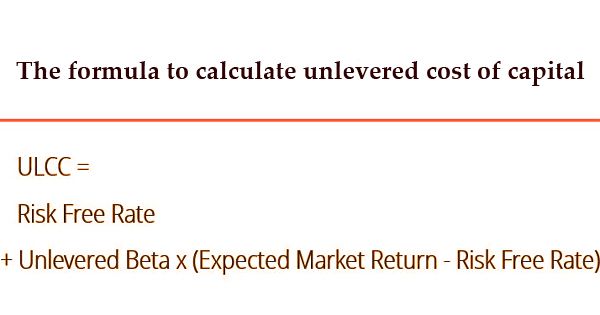

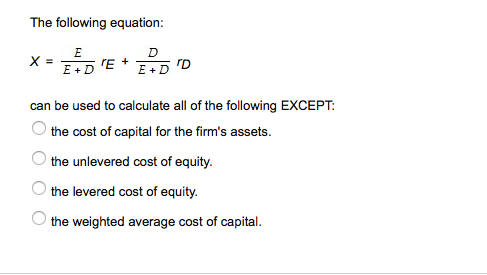

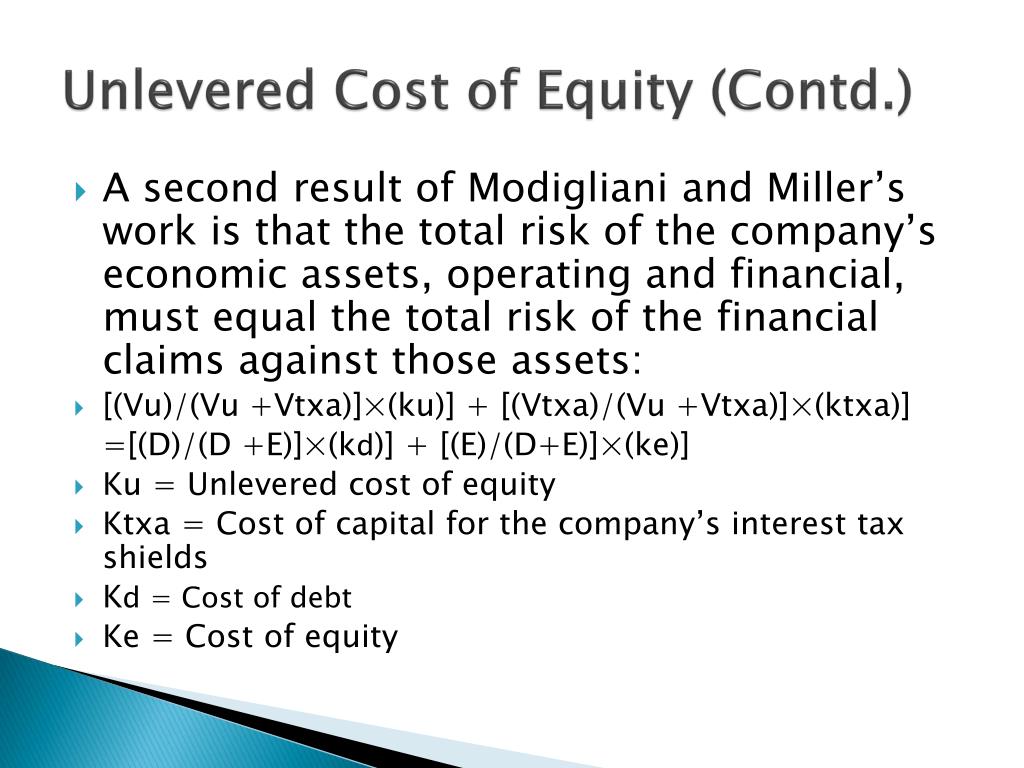

CAPITAL BUDGETING WITH LEVERAGE. Introduction Discuss three approaches to valuing a risky project that uses debt and equity financing. Initial Assumptions. - ppt download